Tax Help for Older People

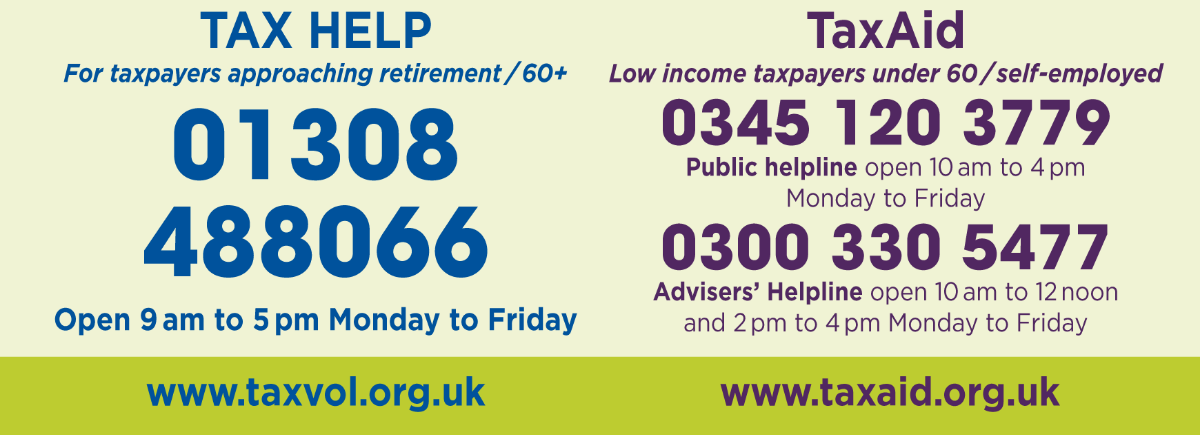

TaxAid and Tax Help for Older People are two UK charities that support people on lower incomes with their tax problems. TaxAid helps people of working age and Tax Help for Older People helps people over 60.

You should call TaxAid or Tax Help for Older People if you

- Need help understanding HMRC’s paperwork, including ‘Pay As You Earn’ issues, letters, bills, statements, and over- or under-payment of tax

- Have a tax debt, penalties and/or interest to pay

- Are having a dispute with HMRC over unpaid debts or penalties

- Have experienced an incorrect determination or estimate of tax made by HMRC on a previous return

- Need help completing tax forms, especially due to difficult personal circumstances

- Have multiple jobs, incorrect tax codes, or unexpected deductions from your pay

- Are working in the gig economy or as a subcontractor, including working in construction or as a delivery driver and need help with your taxes

- have other hardships which might impact your ability to take care of your taxes

Elligibility

You are eligible for the services of TaxAid or Tax Help for Older People if you are:

- Earning approximately £20,000 annually (before tax), or if you are on higher income with:

- Debt of more than 25% of your annual income, or

- If you have other hardships or disadvantages such as (but not limited to) mental or physical health problems, disabilities, relationship problems, bereavements, homelessness, or other similar difficulties.

TaxAid and Tax Help for Older People do not advise on

- DWP benefits including Tax Credits

- Council Tax

- Capital Gains Tax

- Inheritance Tax

- VAT

- Limited Companies